The most recent data from Udyam’s portal shows that, as of December 2022, around 1.28 crore MSME registered industries had a total employment of 9.31 crore, which included 2.18 crore women employees.

In the world of global economics, the term MSME plays a crucial role in fostering the growth and economy of our country. MSME full form is Micro, Small, and Medium Enterprises. These small and medium size businesses develop jobs and, economic development and promote small enterprises. To grasp the knowledge of local and international markets it is essential to know about MSME. In this article, you will get complete information about MSME, its significance, impotence, and more.

What is MSME? (Micro, Small and Medium Enterprises) Loan

MSME stands for Ministry of Micro, Small, and Medium Enterprises. It is an apex body for the implementation and formation of small and medium-sized enterprises. It provides support to industries as ancillary units, these types of enterprises are engaged in:

- Production

- Manufacturing

- processing of goods and commodities

The Micro, Small and Medium Enterprises Development Act, 2006, MSMEs are mainly divided into three parts:

Microenterprise: In this case, the funds allocated for plant and machinery or equipment do not go beyond ₹1 crore, while sales remain under ₹5 crore.

Small enterprise: The investment in the plant and machinery or equipment does not exceed ₹10 crores, and turnover does not exceed ₹50 crores.

Medium enterprise: The plant, machines, or equipment are within prescribed limits of ₹50 crores in value at any given time, with turnover not crossing ₹250 crores.

The Government of India has taken many steps towards generating employment in the country. This scheme is launched to promote businesses and local manufacturing in India. according to the reserve Bank of India

loans are meant for only certain business entities that fall under the following categories:

| Company size(it could be a manufacturing unit or service provider) | Micro | Small | Medium |

| Investment Limit | 1 crore or less | 10 crore or less | 20 crore or less |

| Maximum annual turnover | Up to 5 crore | Up to 50 crore | Up to 100 crore |

Also Read:- MNSSBY Bihar Student Credit Card | Sewayojan Portal | E Shikshakosh Portal

Features and benefits of business (MSME loan)

Now let us know more about the MSME scheme. Below we have mentioned some of the important features and benefits of MSME loans:

- Making a revenue using MSME loan creates a good flow of credit in your business and the general MSME sector.

- An MSME loan can help you accomplish your objectives and create new standards for your business.

- Such loans enable you to upgrade the technology in your business, increase production, or offer better services to customers.

- MSME business loans allow you to grow your business and be more competitive. These loans are open to all types of MSME businesses; it could be a sole proprietorship, partnership firm, private or public limited company, and so on. Also, service-based as well as manufacturing MSMEs are eligible to benefit from this loan but not for educational institutes, self-help groups, and retail traders.

- You can apply for an MSME loan online and get instant approval. Additionally, less paperwork is involved and you do not have to visit the department.

- You can get MSME business credit without having any collateral or security against it i.e. you do not have to pledge any asset with the bank against the amount you are borrowing.

SMEs and MSMEs Know The Difference

As per section 7 of the MSME Development Act 2006 small and medium-sized enterprises are a significant component of the Indian economy and are found in the manufacturing and service sectors. The range is from small grocery shops to large franchise stores.

Certain factors determine whether rural or urban enterprises are micro, small, or medium. Recently, to improve the ease of doing business and create an objective of classification, the government revised the definition of MSMEs by raising the maximum investment limit and introducing turnover requirements as highlighted in the previous section.

Loan Interest Rate (MSME Micro, Small, and Medium Enterprises)

The interest rate of MSME loans has a direct impact on the repayment capacity. The interest rate on MSME is decided on different factors such as:

- Credibility and vintage of your business

- The amount you borrow

- Period of repayment you choose

- Credit score

- Specific lender guidelines

If your business has goodwill in the market and you have been running successfully for the past few years, there are more chances of getting a loan approved without any huddle or delay.

Thus, with better credit scores on record, others trust us because they know we will pay back what we borrowed from them.

The amount you decide to borrow plus the duration chosen for its repayment also affects the interest rate charged; thus if someone takes out some cash but it is too much, expect higher interest payable. Nevertheless, all MSME loans offered by lenders in India have low interest rates so as not to burden businesses when repaying them

Top Banks in 2024: MSME Loan Interest Rates

| Bank Name | Interest rate |

| Central Bank of India | 9.90% p.a. onwards |

| Indian Bank | At the discretion of the bank |

| Punjab and Sind Bank | 9.30% p.a. onwards |

| Punjab National Bank | At the discretion of the bank |

| State Bank of India | At the discretion of the bank |

| UCO Bank | 8.85% p.a. onwards |

| Union Bank of India | At the discretion of the bank |

Required Documents for MSME Loan

One of the basic reasons businessmen apply for MSME loans is they don’t require lots of paper. You just have to keep a few papers with you such as:

- Pan card

- Aadhar card

- Last year’s account statement

- Proof that your business has existed for the previous year

Must Read:- Pradhan Mantri Awas Yojana | Meri Fasal Mera Byora Yojana

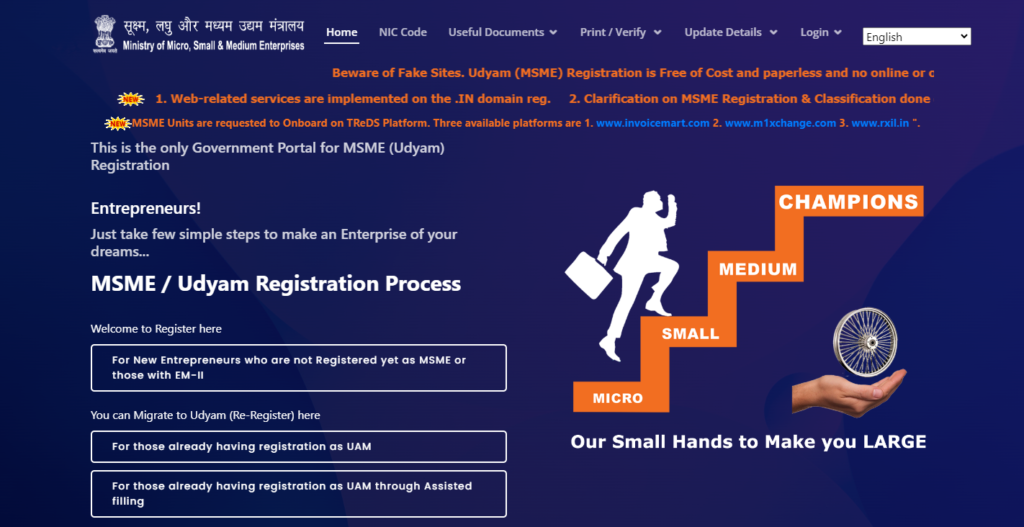

Registration process of MSME: Micro, Small, and Medium Enterprises

If you are a new user follow these easy steps:

- Click on the given link

- https://udyamregistration.gov.in/Government-India/Ministry-MSME-registration.htm.

- Now click on ‘New Entrepreneurs who are not Registered as MSME or those with EM-II’.

- Provide your aadhar details and click on generate OTP. One one-time password will be sent to your registered mobile number. Now provide information on your PAN card.

- Next, provide the details of your industry

- Now click on submit and get the final OTP. Enter the OTP for the successful registration of MSME.

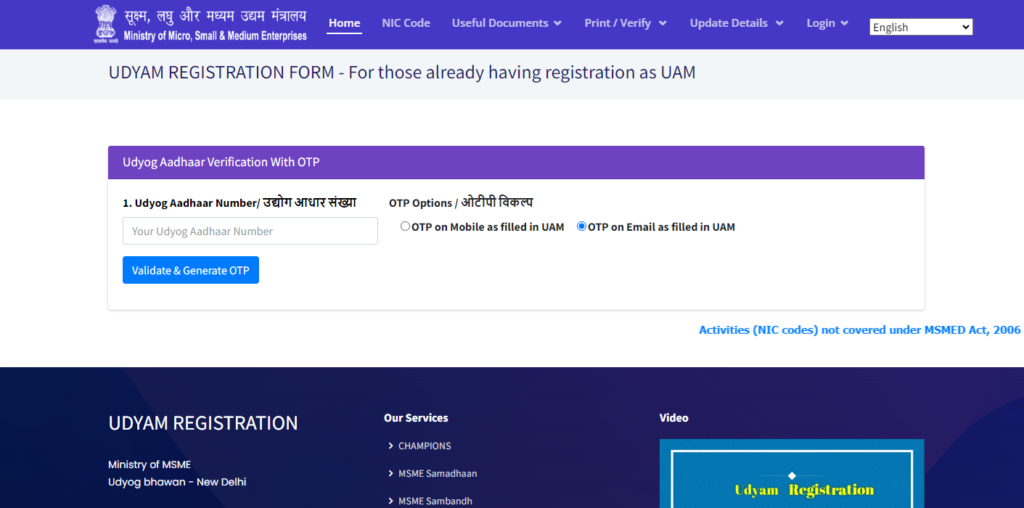

Entrepreneurs Already Having UAM

- Click on the below link

- https://udyamregistration.gov.in/Government-India/Ministry-MSME-registration.htm.

- Click for those having registration as UAM’ or ‘For those already having registration as UAM through Assisted filing’

- Enter your Aadhaar number

- You will get your OTP on your registered mobile number

- ‘Validate and Generate OTP’

- Enter the OTP and your registration process will be completed

Applying for an MSME Loan: Micro, Small, and Medium Enterprises

For applying for an MSME advance there are two methods. In the case of an online lender, just fill in the necessary details and apply on the website.

The other alternative is to visit the nearest department where you can ask them to send you an application form.

Collateral for MSME Loan

Most loaners in India will give you an MSME advance without asking for any collateral or security from you. MSME advances are unsecured credits hence no collateral is required. However, if any lender happens to ask for one then contact him/her and inquire about what kind of collateral you may provide.

We read everything about MSME from MSME full form to its features, steps to login, and more. MSME loan is a great opportunity for micro, small, and medium enterprise owners. without any hassle, you can easily get a loan for your expenditures. The simple application process, quick disbursal time, and minimal documentation make it a go-to financing option for all.

FAQs:

Q1. What is the 15 lakh subsidy for MSMEs?

Ans. There is an allocation of up to 15 lakhs for these smaller enterprises that can adopt advanced technology subsequently enabling them to get it through Credit Linked Capital Investment Scheme (CLCS).

Q2. What is the minimum credit score for an MSME loan?

Ans. When applying for MSME loans, we often think of a minimum CIBIL score of 685. This threshold indicates business stability and debt repayment capacities thereby making it important.

Q3. Are MSME loans collateral-free?

Ans. The best part about these loans is that you don’t have to put up any assets or anything else as collateral against them being paid back. It helps one start or expand their business without going through many government formalities because eligibility conditions are simple with very little paperwork.