In India, schemes supported by the government can always be defining to empower women. Bima Sakhi Yojana is one such massive initiative that has attracted huge attention recently. In this comprehensive guide, for you to understand in simple and easy language about LIC Bima Sakhi Yojana, how to apply, eligibility, target and last date then this guide is for you.

In this blog, we will cover:

- What is Bima Sakhi Yojana

- Important Features of LIC Bima Sakhi Scheme

- Benefits and eligibility criteria

- The online process of applying for LIC Bima Sakhi Yojana

- LIC Bima Sakhi Yojana apply online last date info

- How to Register Online to LIC Bima Sakhi Yojana

- Target of LIC Bima Sakhi Yojana – How LIC Bima Sakhi Yojana Works – LIC Bima Kashi Implementation – How to Join LIC Bima Sakhi Yojana.

- Frequently asked questions

What is Bima Sakhi Yojana?

Bima Sakhi Yojana is a scheme which will help women to work as insurance agents under LIC (Life Insurance Corporation of India). These scheme primarily aims to provide employment opportunities to women at at least minimum level to be financially independent especially in semi-urban and rural areas.

As per LIC Bima Sakhi Yojana, women will be honed and designated as LIC specialists to make a mindfulness about life coverage items and monetary security in their own spaces. Not only does this scheme provide women with a regular source of income but it also increases insurance penetration in the length and breadth of India.

The underlying idea of the Bima Sakhi Yojana is thus fairly uncomplicated – empower women, empower families, empower financial literacy.

Benefits of Joining Bima Sakhi Yojana of Life Insurance Corporation of India – Step by Step Explained

| Step | Benefit Title | Key Points | How It Helps You |

|---|---|---|---|

| Step 1 | Financial Independence | • Commission on every policy sold • Performance-based income • No large investment needed • Part-time income opportunity | Helps women start earning on their own and contribute financially to the family. |

| Step 2 | Skill Development | • Professional training from LIC • Communication skill improvement • Knowledge of insurance products • Marketing & networking skills | Builds confidence, improves personality, and prepares women for long-term career growth. |

| Step 3 | Social Respect | • Association with trusted LIC brand • Recognized as financial advisor • Community trust building • Helps families with financial planning | Increases social recognition and builds credibility in society. |

| Step 4 | Unlimited Income Potential | • No fixed salary limit • Higher sales = higher commission • Renewal commission income • Incentives for achieving LIC Bima Sakhi Yojana target | Provides long-term earning potential without income restrictions. |

| Step 5 | Work-Life Balance | • Flexible working hours • No strict office timing • Manage family and work together • Suitable for homemakers | Allows women to balance professional and personal responsibilities smoothly. |

| Step 6 | Low-Risk Career Option | • Minimal registration cost • No office setup required • No product inventory needed • Training provided | Reduces financial risk and makes it easy to start. |

| Step 7 | Long-Term Career Growth | • Strong client network building • Regular renewal income • Financial advisory experience • Awards and recognition opportunities | Converts a small opportunity into a stable and growing career over time. |

Benefits of Joining Bima Sakhi Yojana

You have the intension of joining listed under Bima Sakhi Yojana, and then very follow that up with very clear idea on the method by which this post of yours is gonna change your life. The following are simple and desktop based steps explaining the key advantages of LIC Bima Sakhi Yojana;

1st step: find financial freedom – earn for yourself

- Financial independence is the first and foremost advantage of Bima Sakhi Yojana.

- LIC Bima Sakhi Yojana: Once you enroll with the LIC Bima Sakhi Yojana you will get each and every commission on a policy you sell.

- Your earnings are directly related to your performance, so there is actual potential for growth in that area!

- Starting does not require a lot of investment.

- Got some extra time on your hands and looking to make some money online?

Step2: Learning New Skills while Earning

- With LIC Bima Sakhi Yojana, you don’t merely earn – you prosper.

- Here’s how:

- LIC provides you with professional training.

- You learn communication skills.

- You have knowledge of financial products and insurance planning.

- You acquire marketing and customer handling skills.

- You develop the skills of speaking in public and networkin.

Step 3: Social respect – Earn the trust of your community

- Having a work experience of LIC brings you firm recognition.

- LIC is among the most trusted insurance brands in India.

- Nobody takes you seriously, when you represent LIC Bima Sakhi Yojana.

- You become a member of your communities financial advisory board.

Step4: Kittaa v zahar – No hard salary cap

- LIC Bima Sakhi Yojana offers an exciting opportunity to earn unlimited income.

- There is no fixed salary cap.

- Selling more policies entails a higher commission.

- Renewal commissions add long-term income.

- Performance-based rewards and excitement may be given.

Step 5: Finding balance between work and life – Working hours are flexible

- Another great advantage of Bima Sakhi Yojana is flexibility.

- Flexibility to set your own working hours

- There is no 9 to 5 type of work.

- Which means you can easily manage household chores.

- This makes it possible to organize meetings at convenient times.

- Ideal for homemakers and mothers.

Step 6: Low Risk Career Path

- Bima Sakhi Yojana does not have any heavy investment.

- Minimal registration cost.

- No office rental required.

- No stock or product inventory is required.

- Training is provided by LIC.

- Hence, LIC Bima Sakhi Yojana is a career with minimum risk and maximum opportunity.

Step 7: Long-Term Career Growth

- Women are also able to:Under Bima Sakhi Yojana with consistent work

- Build a strong client network.

- Earn renewal commissions for years.

- Gain experience in financial advisory.

- Eligibility to top awards and recognition programs.

Eventually, what begins as a leap towards LIC Bima Sakhi Yojana can lead to a solid long-term job.

Motive behind LIC Bima Sakhi Yojana

LIC Bima Sakhi Yojana has the following main objectives:

- To promote women’s employment.

- To make people aware about life insurance in rural sector.

- For better financial literacy in households.

- To inspire women to be self-dependent and self-employment.

- Bima Sakhi Yojana aids women in learning about insurance products, customer handling and selling techniques to give them a stable career.

Key Features of LIC Bima Sakhi Yojana

LIC Bima Sakhi Yojana: An overview of all features in a simple and practical way If you are planning to Read: LIC Bima Sakhi Yojana: Details in point to point manner The scheme is explained here at each point which makes it beneficial and why women are showing so much interest here.

1. Women-Centric Scheme

This scheme is specially designed for women. Only eligible women candidates can participate in Bima Sakhi Yojana.

2. Free Training

Selected candidates under LIC Bima Sakhi Yojana receive proper training from LIC to understand insurance products and policies.

3. Attractive Commission Structure

Participants earn commission on policies sold. The more policies they sell, the higher their earnings.

4. Flexible Working Hours

One of the biggest advantages of Bima Sakhi Yojana is flexibility. Women can manage household responsibilities along with work.

5. No Heavy Investment Required

To join LIC Bima Sakhi Yojana, you do not need a huge capital investment. Basic registration and training are provided.

Documents Required for LIC Bima Sakhi Yojana

For LIC Bima Sakhi Yojana online registration, you will generally need:

- Aadhaar Card

- PAN Card

- Passport-size photographs

- Educational certificates

- Bank account details

- Mobile number and email ID

Keep these documents ready before starting the LIC Bima Sakhi Yojana apply online process.

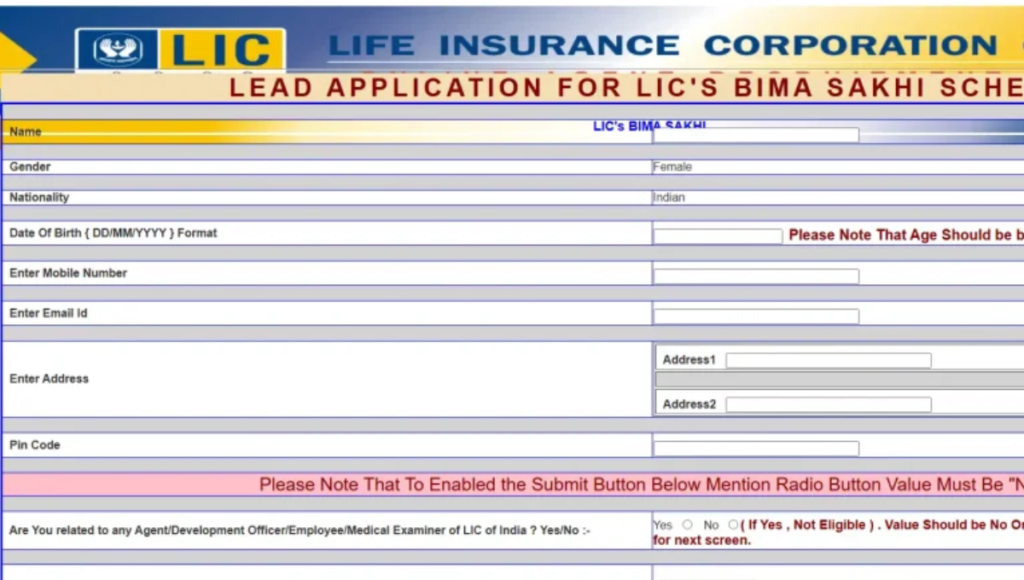

How to Apply for LIC Bima Sakhi Yojana Online – Procedure Step by step

If the answer to it is Yes, then here is the stepwise guide on how to LIC Bima Sakhi Yojana apply online.

Step 1: Go to the LIC Official Site

Visit the official LIC website or approach the nearest LIC branch.

Then step 2: Search for the agent registration portion

“LIC Bima Sakhi Yojana” agent recruitment or career opportunity

Step 3: Complete Your Application Form

Fill in your information including:

- Name

- Date of Birth

- Address

- Educational qualification

- Contact details

Step 4: Upload Required Documents

Required documents for LIC Bima Sakhi Yojana online registration – upload scanned copies of documents.

Step 5: Submit the Form

Once being assured that, details are filled correctly, submit the application form.

Step 6: Interview & Training

If shortlisted you will called for interview{and trainning under Bima Sakhi Yojana}

This is the end of LIC Bima Sakhi Yojana apply online.

Read Also: PM Vishwakarma Yojana|Kanya Sumangala Yojana|Sukanya Samriddhi Yojana

Online date of apply LIC Bima Sakhi Yojana

Questions related to LIC Bima Sakhi Yojana apply online last date are among the most search questions.

However, there is no national last date for applying as LIC is likely to recruit agents under Bima Sakhi Yojana round the year. However, certain branches can declare a particular cutoff date.

- Therefore, the best practice is always to:

- Better to Check in your nearest LIC branch.

- Visit the official website regularly.

- To prevent missing the LIC Bima Sakhi Yojana apply online last date in your area, apply as early as possible.

LIC Bima Sakhi Yojana Online Registration – KEY POINTS

Here are a few points to take care of while applying for LIC Bima Sakhi Yojana Online Registration:

- Ensure all details are correct.

- Use a valid mobile number.

- Double-check uploaded documents.

- Ensure to keep a copy of the application submitted

The LIC Bima Sakhi Yojana online registration is an easy and quite user-friendly process but it is important to fill the form accurately or else it can be rejected.

LIC Bima Sakhi Target Understanding

LIC Bima Sakhi Yojana Target: A lot of candidates have a query on LIC Bima Sakhi Yojana Target.

Soon after you become a LIC agent under Bima Sakhi Yojana you will be assigned monthly or quarterly sales targets. These targets usually depend on:

- Number of policies sold

- Premium amount collected

- Business performance

The LIC Bima Sakhi Yojana number is more of a target than pressure as it aims at Sustaining Behaviour. Meeting targets can help you:

- Earn higher commissions

- Get recognition and rewards

- Build a strong client base

However, with appropriate training and by networking with the community, you can reach the LIC Bima Sakhi Yojana target with ease in due course of time.

Importance of LIC Bima Sakhi Yojana for Women in Rural Areas

Job opportunities for women are low, particularly in rural settings. Thus, Bima Sakhi Yojana fills this gap by providing,

- Local earning opportunities

- Financial literacy awareness

- Community leadership roles

Women become financial advisors in their villages by helping families understand savings and insurance, through LIC Bima Sakhi Yojana.

Challenges in LIC Bima Sakhi Yojana

While Bima Sakhi Yojana offers many benefits, there can be some challenges:

- Building trust initially

- Meeting the LIC Bima Sakhi Yojana target

- Handling rejections from customers

However, with patience and consistent effort, these challenges can be overcome

(FAQs) Related to Bima Sakhi Yojana

1. What is Bima Sakhi Yojana?

Under the Life Insurance Corporation of India, Bima Sakhi Yojana is an effort to provide women an opportunity to be a LIC agent. Under this empowerment for women scheme, training will be given to the women, flexible work will be done, and commission will be earned.

2. How to fill LIC Bima Sakhi Yojana apply online?

The LIC Bima Sakhi Yojana apply online can be done through the official LIC webpage or nearest branch.

3. What is the last date for LIC Bima Sakhi Yojana apply online?

A deadline could be set, he said, but not built into federal law. You may visit your nearest branch for the LIC Bima Sakhi Yojana apply online last date.

4. How to fill LIC Bima Sakhi Yojana online registration

If you want to get your forma that is LIC Bima Sakhi Yojana Online Fill the out and upload documents and submit it from the official website.

5. What is the objective of LIC Bima Sakhi Yojana?

Target under LIC Bima Sakhi Yojana — It refers to the expected sales performance from agents.

6. Which entities can apply LIC Bima Sakhi Yojana?

The applicant must fulfill following criteria to apply for LIC Bima Sakhi Yojana –

Be a woman

Be at least 18 years old

At least 10th or 12th pass Educational qualification required

Possess basic communication skills

7. How to Apply Online for LIC Bima Sakhi Yojana?

Steps to do LIC Bima Sakhi Yojana apply online are:

Visit the official LIC website

Contact your nearest LIC branch

Fill out the application form

Upload required documents

Fill the form and if selected appear for the training/interview.

It is easy to use and straight-forward.

8. Target of LIC Bima Sakhi Yojana

LIC Bima Sakhi Yojana target is actually the business performance targets of sales given to agents. It may include:

Number of policies to be sold

Premium collection amount

Monthly or quarterly business goals

Final Thoughts

Bima Sakhi Yojana is not just a centre of employment only. This would be part of advancing power and money in the hands of women, strengthening them, and consequently the families as well. With the LIC Bima Sakhi Yojana thousands of women, can earn a livelihood, work for and build a career, command respect and look after their families.If you want to make a rewarding career sector at your time, then apply online through LIC Bima Sakhi Yojana today. Complete Your LIC Bima Sakhi Yojana Online Registration Now And Do Not Wait For The LIC Bima Sakhi Yojana Apply Online Last DateSetting the LIC Bima Sakhi Yojana goal is indeed achievable with the use of dedication and persevering efforts.Empower yourself. Build your future. Enroll today and take your first step towards financial freedom with Bima Sakhi Yojana.