On 5 December 2023, 56.58 lakh street vendors benefited from the loans under Prime Minister Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi) Scheme since its inception.

PM SVANidhi Scheme: During the COVID-19 pandemic, the GOI has taken a crucial step to uplift the informal sector and support street vendors of India. Pradhan Mantri Street Vendor’s Atmanirbhar Nidhi (PM SVANidhi) scheme announced in 2020 offers micro-credit facilities to restore the business of street vendors. With this initiative, the government aims to create a supportive ecosystem for street vendors, enabling them to access financial resources, expand their businesses, and contribute to the economic vibrancy of urban areas.

Details Of PM SVANidhi Scheme: Prime Minister Street Vendor’s AtmaNirbhar Nidhi

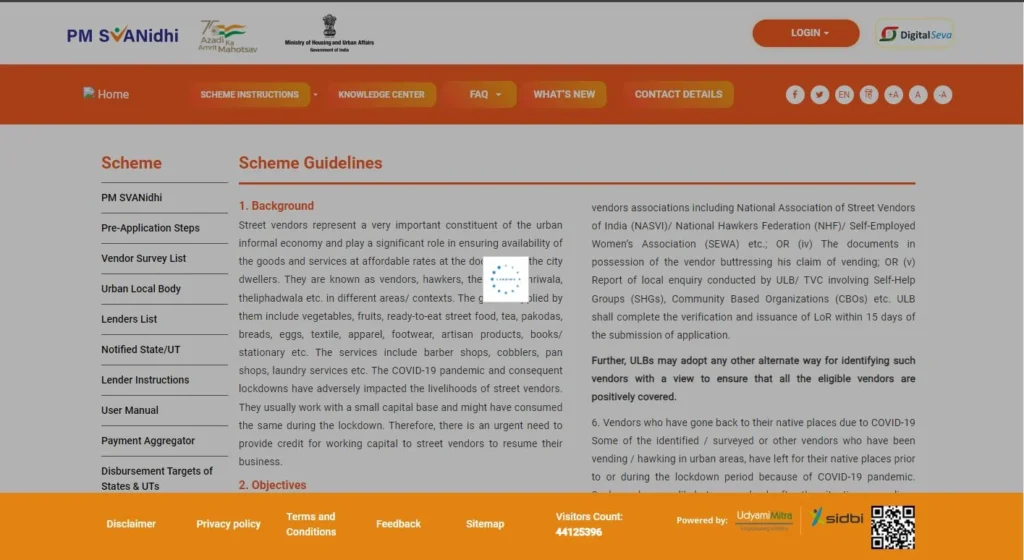

All Information is Here According to Bhulekh Bhoomi, PM SVANidhi is an abbreviation of Prime Minister Street Vendor’s AtmaNirbhar Nidhi. The agenda of the scheme is to provide micro-credit facilities to street vendors affected by the COVID-19 pandemic.

PM SVANidhi was introduced by MoHUA as a central sector micro-credit scheme to empower street hawkers on 1 June 2020. As part of the scheme, all street vendors can obtain a working capital loan of INR10,000 without any collateral, while further loans of INR20,000 and INR50,000 will be available for them at a 7% interest subsidy. This initiative seeks to increase the banking footprint in India by encouraging digital financial transactions among street vendors. To promote digital transactions, street vendors are reimbursed with cashback up to INR100 monthly.

| Full-Form of PM SVANidhi | Prime Minister Street Vendor’s Atmanirbhar Nidhi |

| Launch Date | 1st June 2020 |

| Under which government ministry? | Ministry of Housing and Urban Affairs (MoHUA) |

| Target Beneficiary | Street Vendors or hawkers in urban areasStreet Vendors of peri-urban areasStreet Vendors in Rural areas(Those street vendors as on/before 24th March 2020) |

| Mandatory Documents to Access Benefits | Aadhar CardVoter Identity Card |

| Tenure of the scheme | June 2020 – March 2022 |

| Direct Link to avail of the benefits under the PM SVANidhi | https://pmsvanidhi.mohua.gov.in/ |

Important Features and Basic Objectives: PM SVANidhi Scheme

Let us get some more information regarding the PM SVANidhi Scheme below you can read some important features and objectives of the scheme:

- This scheme is a central sector scheme

- Provide affordable working capital loans to street vendors who suffered during the pandemic period

- Vendors will be provided annual working capital of Rs. 10000

- The vendor will get an interest subsidy at 7 percent at early or timely repayment of loans

- Gives monthly cashback of Rs 50-100

- If the vendor repays the previous loan on time then there is a higher chance of getting a loan again

- No collateral security is required

- Provide affordable working capital loans

- Digital repayment of loans is available

Also Read:- Pradhan Mantri Awas Yojana || Mahtari Vandana Yojana || Atal Pension Yojana

Key Advantages of PM SVANidhi Scheme

- The loan is provided with a low interest rate of 7%

- No collateral security is required

- No processing fee is applied in the scheme

- Provide financial stability to vendors. Help them to become self-reliant

- This scheme is available at the national level in all state and union territories, for all street vendors across the country

Financial Institutes Under (PM SVANidhi Yojna)

Few financial institutes support PM Svanidhi Yojna and provide financial help to street vendors. Some of them are:

- Self Help Groups (SHG) Banks

- Scheduled Commercial Banks

- Regional Rural Banks

- Non-Banking Financial Companies

- Micro-Finance Institutions

- Cooperative Banks

Eligibility Criteria

Only those States/UTs that have informed Rules and Schemes under the Street Vendors (Protection of Livelihood and Regulation of Street Vending) Act, 2014 can benefit from this Scheme. However, people from Meghalaya who own the Town Vending Act may also apply for it.

Also Read:- What is Pradhan Mantri Kisan Samman Nidhi Yojana? || France and Italy’s Premier Film Festivals

Important Documents For Application Process

| 1. | Certificate of vending |

| 2. | Letter of recommendation |

| 3. | Aadhar card voter ID card |

| 4. | Driving license |

| 5. | MNREGA card |

| 6. | Pan card |

| 7. | Copy of passbook and amount statement |

| 8. | Request letter of ULB |

| 9. | Loan closer documents |

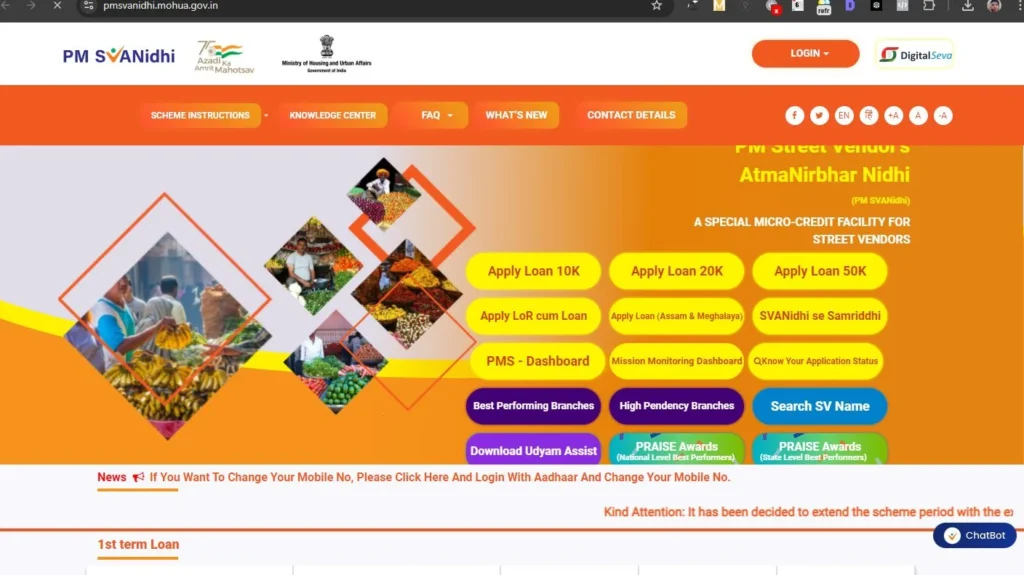

Application Process of SVANidhi Scheme: Basic Steps to Follow

Below we have mentioned the basic steps to fill out the application form for the SVANidhi Scheme

- Visit the official website https://pmsvanidhi.mohua.gov.in/

- Click on the login button

- Enter mobile no. and captcha request for OTP

- Select vendor category” among the available options. Enter “Survey Reference Number” (SRN) which is mandatory

- Fill out the application form online and fill in the documents

| Note:For any help refer to User Manual.Or you can call on toll-free no. 1800111979 between 9.30 AM to 6.00 PM Monday to Saturday except for national holidays. |

Also Read:- PM Awas Yojana Gramin List || Pradhan Mantri Awas Yojana || Pradhan Mantri Fasal Bima Yojana

Conclusion:

Ultimately, the use of unconventional monetary interventions and the promotion of inventive start-up businesses, PM SVANidhi makes a path for a more pliable and fair economy where each street hawker flourishes. The PM SVANidhi Conspire emphasizes the importance of inclusive growth and recognizing street vendors as key actors in the Indian economy’s transformation process.

FAQs:

Q1. What is the eligibility of the PM SVANidhi 20000 loan?

Ans:- The eligibility criteria are defined as:

- Certificate of Vending / Identity Card issued by Urban Local Bodies (ULBs).

- The vendors, who have been identified in the survey but have not been issued Certificate of Vending / Identity Card.

Q2. What is the loan amount for PM SVANidhi 50,000?

Ans:- The last date under the PM SVANidhi Scheme is extended till December 2024. All loan claims for credit guarantees and interest subsidies will be processed by March 2028. A borrower can now take a second loan of up to ₹20,000 and use it to repay the first one of up to ₹50,000 with 36 months of maturity.

Q3. What is the repayment period of a PM SVANidhi loan?

Ans:- The eligibility criteria for receiving SVs include applying through the Udayamimitra portal, availing of the second tranche of a loan from our Bank, and repaying it in time. The minimum as well as maximum loan amounts are Rs. 20,000/- and Rs. 50,000/- respectively. The minimum tenure period is 18 months (EMI) whereas the maximum is 36 months (EMI).

Q4. What is the SBI report on PM SVANidhi?

Ans:- As per a recent study conducted by SBI, the scheme has achieved great performance, with 43% of recipients being women street vendors. In addition, 44 percent of PM SVANidhi beneficiaries are from the OBC category while 22% belong to the Scheduled Caste and Scheduled Tribe categories.