Your daughter, like all daughters, is your precious one. The costs are now raising for education, and there are expenses for marriage as well, which can put a strain if not planned well. The Government of India launched the Sukanya Samriddhi Yojana as part of the Beti Bachao Beti Padhao initiative to assist families and ensure the welfare of the girl child.

Sukanya Samriddhi Yojana name itself says save for a girl child for her well being) is a long-term and small savings scheme of the Government of India aimed at the financial empowerment of the girl child. It is one such scheme which is one of the most reliable options for investments in India, thanks to its high interest rates, tax benefits and assured returns.

This in-depth guide covers Full Details like eligibility, age limit, interest rates, calculator, tax benefits, online apply process, and post office account.

What is Sukanya Samriddhi Yojana?

Launched in 2015, Sukanya Samriddhi Yojana is a small savings scheme to encourage the parents to save towards their daughter’s future. It enables parents or guardians to open an account in the name of a girl child and make monthly deposits till maturity.

What is the ultimate goal of this Scheme:

- So as to insure a girl kid financially

- To promote long-term savings habits

- To ease the financial burden of education and marriage

- To support women empowerment

Sukanya Samriddhi Yojana facility is fully secured one with good returns as it is provided by & bathed under Govt Of India.

Benefits of Sukanya Samriddhi Yojana

Here are the major advantages:

- Government-backed safety

- High interest rates

- Long-term compounding

- Tax-free returns

- Best for future planning of girl child

- Low minimum deposit

- Guaranteed returns

This is a unique scheme that blends both safety and growth which is the key ingredient to a successful life.

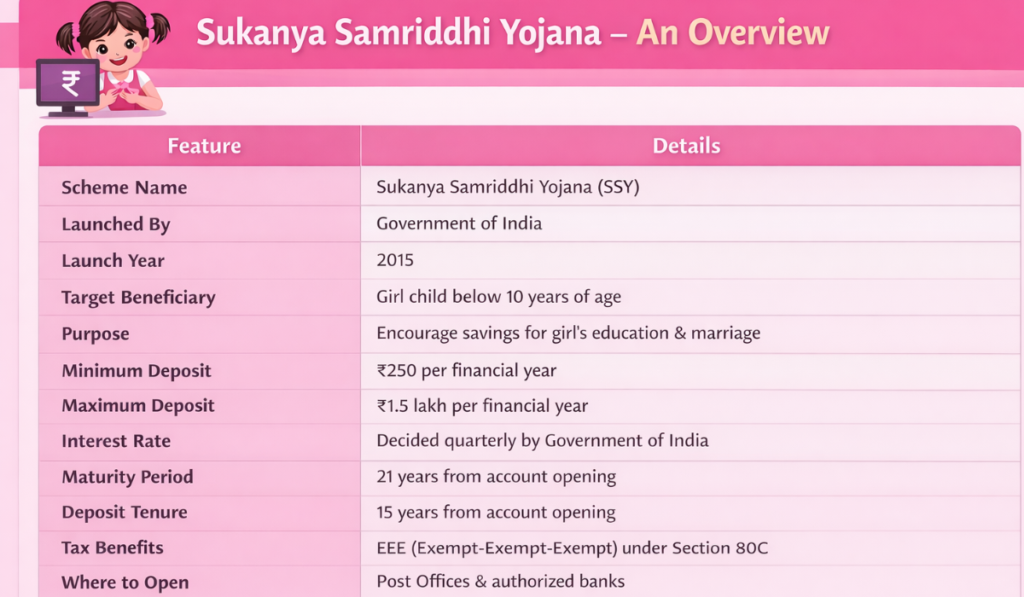

Sukanya Samriddhi Yojana Full Details

Always read Details before investing.

Here are the key features:

- Scheme for girl child only

- Minimum deposit: ₹250 per year

- Maximum deposit: ₹1,50,000 per year

- Deposit period: 15 years

- Maturity period: 21 years

- Interest compounded annually

- The ability to do partial withdrawal post 18 years

- Fully government guaranteed

And these are some of the features that make the Sukanya Samriddhi Yojana among the safest and highest return small savings schemes in India.

Sukanya Samriddhi Yojana – An Overview

Sukanya Samriddhi Yojana Age Limit

The age limit has just one rule —

- The girl child must be less than 10 years at the time of opening the account.

- Two Children Policy — Only Two Girl Children Are Allowed Per Family (exceptions for twins or triplets).

The money deposited in a Sukanya Samriddhi Yojana account takes some time to grow, and the sooner you start investing, the more your return will be.

Sukanya Samriddhi Yojana Interest Rates

The biggest positive point about this Scheme that attracts people is the interest rate on the investment. The interest rates of Sukanya Samriddhi Yojana is determined by the Government of India and changes every quarter.

Important points:

- Interest is compounded annually

- Typically, it is higher than fixed deposits.

- Government guaranteed returns

- Interest is tax-free

Next, since the Sukanya Samriddhi Yojana interest rates are mostly higher than most of the traditional savings, the final maturity amount is quite huge after 21 years.

Do not invest without prior checking of the latest Sukanya Samriddhi Yojana interest rate.

Sukanya Samriddhi Yojana Calculator

The calculator also guides you in your financial planning using the this. Let us take into consideration the investment which the parents have made for the child over the span of at least 21 years.

You can check Maturity amount by entering the following values: — Income, Retirement age, Term, Annuity /premium amount

- Annual investment amount

- Expected interest rate

- Investment duration

Example:

So a one-time investment of ₹1,50,000 can give you maturity over ₹60 lakh, assuming 8% average interest for 15 years.

A Sukanya Samriddhi Yojana calculator will be of help as it will assist you in:

- Plan education expenses

- Estimate marriage fund

- Decide yearly investment amount

- Compare returns with other schemes

This calculator makes it easy to plan more accurately and makes everything more transparent.

Sukanya Samriddhi Yojana Post Office

Among all savings accounts, Sukanya Samriddhi Yojana post office account is the most favorite post office account in all over India, particularly in rural and semi-urban areas.

Advantages of having Sukanya Samrddhi yojana post office account:

- Wide accessibility across India

- Simple documentation

- Safe and secure government process

- Easy transfer facility between branches

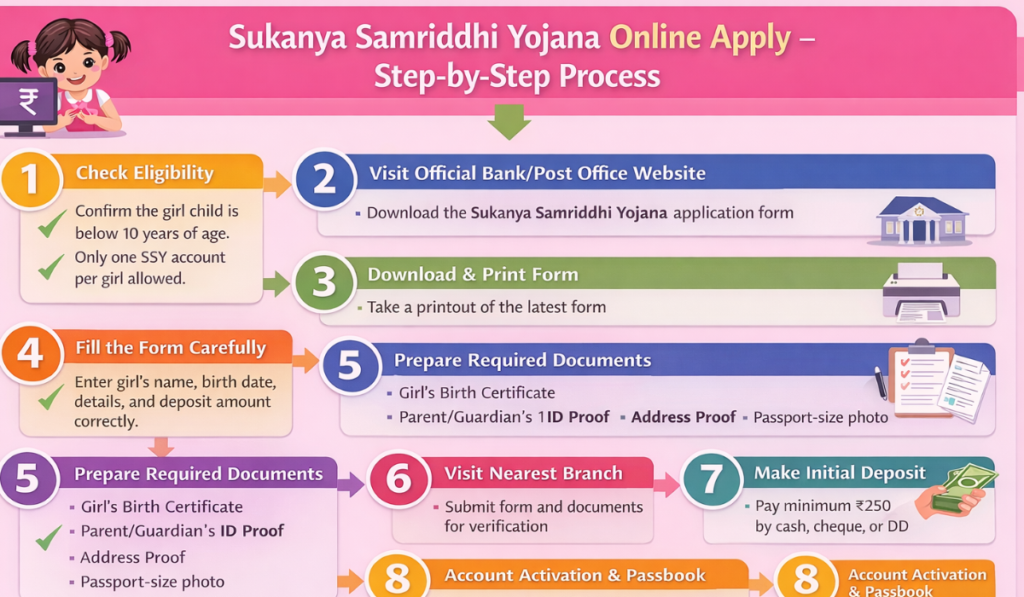

Sukanya Samriddhi Yojana Online Apply

Below is the entire process of how to open Sukanya Samriddhi Yojana(SSY) in a few straightforward steps.

Step 1: Ensure the Girl Child

The Age of 10 Years You can open only one SSY account in the name of one girl child. A parent or legal guardian can open the account.

Step 2: Go to the Official Website of the Bank or Post Office

Step 3: Download Sukanya yojana application from the official website www.indiapost.gov.in

DL and Print Application Form

The form was then downloaded and printed. Ensure you are using the most current application form.

Step 4: Fill the Form Carefully

Fill the girl child name, dob, parent/ guardian details, address, and correct deposit amount. Providing incorrect information can lead to application rejection.

Step Prepare Required Document

Step 5: Documents to be attached with the application form:

- Girl child’s Birth Certificate

- ID Proof of Parent/Guardian (Aadhaar, PAN, etc.)

- Address Proof

- Passport-size photograph

Step 6: Go to The Closest Branch

Fill up the form and submit it to nearest branch of bank or post office with all the required documents attached. It requires physical verification, which means you will have to visit the branch

Step 7: Make the Initial Deposit

Open the account with an initial deposit of as low as ₹250. Cash, cheque, or demand draft (as per bank rules) is accepted for payment.

Step 8: Account Activation and Passbook Collect

Upon verification, your SSY account will be activated, and you will be provided a passbook. Track your balance and transactions through net banking if bank offers online services.

Upon verification, your SSY account will be activated, and you will be provided a passbook. Track your balance and transactions through net banking if bank offers online services.

Currently:

- Opening an account typically involves going to a bank or post office.

- Download application form from the Internet.

- If you turn it on, certain banks will facilitate online deposits.

Read more: PM Kisan Samman Nidhi Scheme

Sukanya Samriddhi Yojana Tax Benefits

Tax benefits:

- Section 80C deduction (limited to ₹1.5 lakh / year)

- Interest earned is completely tax-free

- Maturity amount is tax-free

- Falls under EEE category (Exempt-Exempt-Exempt)

Due to these tax benefits on Sukanya Samriddhi Account is one of the most tax-saving vehicles you have in India.

Rules of Deposit

- Sukanya Samriddhi Yojana has a flexible deposit structure.

- Minimum deposit: ₹250 per year

- Investment limits: One Ladakh per year

- Caveats (also allowed for deposit only for 15 years)

- After 15 years, no money down

- Interest continues till 21 years

Compounding also means that even a small deposit every year leads to a big corpus.

Withdrawal Rules

Your withdrawal flexibility is determined by the Sukanya Samriddhi Yojana.

Partial Withdrawal

- Allowed after girl turns 18

- Up to 50% of the balance

- For higher education

- Full Withdrawal

- After 21 years

- Or marriage after 18 years

These guidelines which make Sukanya Samriddhi Yojana seem practical and family centric.

Example Calculation of Returns

Now, lets clarify with a real life example:

- Annual Investment: ₹1,00,000

- Investment Period: 15 years

- Interest Rate: 8% (approx.)

- Total Investment: ₹15,00,000

- Approx. Maturity Value: ₹40–45 lakh

When yearly investment is higher, maturity value rises sharply.

A calculator is useful in visualizing these numbers, such as one for the Sukanya Samriddhi Yojana.

Who Should Invest?

- Ideal for: This Scheme

- Parents of young daughters

- Risk-averse investors

- Middle-class families

- Long-term planners

- People seeking tax-saving investments

Sukanya Samriddhi Yojana is a great choice if you seek safe, assured and tax-free returns.

Common Mistakes to Avoid

- Sukanya Samriddhi Yojan: A big announcement while investing

- Never lose out on minimum yearly deposit

- Open account early

- Avoid premature withdrawal unless necessary

Keep a tab on Sukanya Samriddhi Yojana interest rate

Proper planning ensures maximum benefits.

Is Sukanya Samriddhi Yojana safe?

Yes, it is fully government-backed.

Is it possible to transfer a Sukanya Samriddhi Yojana account?

Yes, anywhere in India.

Is online apply possible for Sukanya Samriddhi Yojana?

Application for Sukanya Samriddhi Yojana form can be obtained online but typically needs a branch visit.

What is Sukanya Samriddhi Yojana and how does it function?

It is an Indian Central Government Scheme which works in tandem with the Government scheme for a girl child. With one of these accounts, parents or guardians pay into it for 15 years, and, after 21 years, the account grows up. The entire amount deposited earns interest, compounded yearly, and it helps in creating a tax-free corpus for higher studies or getting married.

Current Sukanya Samriddhi Yojana Interest Rate

Although the interest rate on deposits made under this Yojana is set by the Government of India, it is reviewed and changed quarterly. Interest rates here are typically higher than on fixed deposits and many other small savings schemes. Interest is compounded annually at the end of every financial year, and it gets credited to the account.

What is the age limit for account opening under Sukanya Samriddhi Yojana?

The age limit states that the girl child must be below the age of 10 at the time of account opening. The scheme provides for only one account to be opened per girl child in a family, and a maximum of two accounts can be opened in the family.

How can one avail tax benefits under Sukanya Samriddhi Yojana?

tax benefits are included under Section 80C, which offer tax-deductions for investments upto ₹1.5 lakh per annum. In addition, both the interest earned and maturity amount is tax-exempt under EEE (Exempt-Exempt-Exempt) category.

Can I Withdraw Money Before Sukanya Samriddhi Yojana Maturity?

Yes, 50% amount is allowed under this plan after girl 18 years of age, only for higher education. Finally, full exit is allowed after 21 years or when marrying after 18 years of age.

Final Conclusion

Amongst the most trusted girl child long-term saving schemes in India is the Sukanya Samriddhi Yojana. It not only means security and growth due to attractive Sukanya Samriddhi Yojana interest rates, strong compounding benefits, flexible deposits, and excellent Sukanya Samriddhi Yojana tax benefits.

Be it checking out Sukanya Samriddhi Yojana age limit, searching for Sukanya Samriddhi Yojana online apply, planning via a Sukanya Samriddhi Yojana calculator or simply visiting a Sukanya Samriddhi Yojana post office branch to style, this scheme secures your daughter future.

With all the benefits of Sukanya Samriddhi Yojana, you can provide a powerful financial basis for your child future, in case you start early and invest regularly.